|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Strategic

decisions & Working Capital (WC)

|

|

|

|

|

|

|

Investment

decisions |

|

|

Modes of diversification

: |

|

|

Inter-Organizational relationships

: |

|

|

|

|

|

Others : |

|

|

|

|

|

Long-Term

Financial decisions |

|

|

|

|

|

|

|

Investment

analysis and decision |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

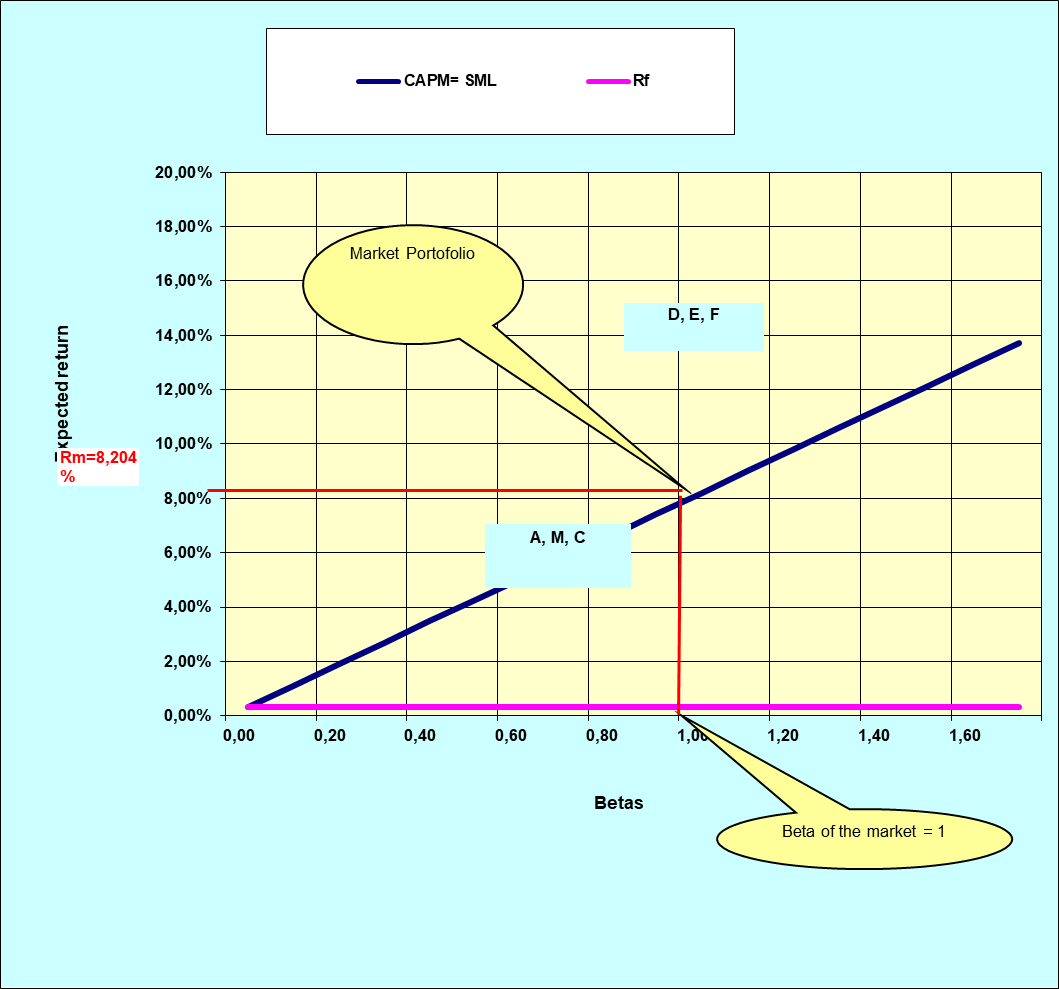

THE SECURITY

MARKET LINE (SML)

Firms |

β |

R f |

R m |

CAPM= SML |

|

0,00 |

0,317% |

8,204% |

0,32% |

|

0,10 |

0,317% |

8,204% |

1,11% |

|

0,20 |

0,317% |

8,204% |

1,89% |

|

0,30 |

0,317% |

8,204% |

2,68% |

|

0,40 |

0,317% |

8,204% |

3,47% |

|

0,50 |

0,317% |

8,204% |

4,26% |

|

0,60 |

0,317% |

8,204% |

5,05% |

A |

0,70 |

0,317% |

8,204% |

5,84% |

M |

0,80 |

0,317% |

8,204% |

6,63% |

C |

0,90 |

0,317% |

8,204% |

7,42% |

Market |

1,00 |

0,317% |

8,204% |

8,204% |

D |

1,10 |

0,317% |

8,204% |

8,99% |

|

1,20 |

0,317% |

8,204% |

9,78% |

E |

1,30 |

0,317% |

8,204% |

10,57% |

|

1,40 |

0,317% |

8,204% |

11,36% |

F |

1,50 |

0,317% |

8,204% |

12,15% |

|

1,60 |

0,317% |

8,204% |

12,94% |

|

1,70 |

0,317% |

8,204% |

13,72% |

Example of Portofolio

Firms |

Allocation of funds |

Expected Return |

Betas |

Risk Premium |

A |

15,0% |

5,84% |

0,70 |

5,52% |

M |

20,0% |

6,63% |

0,80 |

6,31% |

C |

18,0% |

7,42% |

0,90 |

7,10% |

D |

22,0% |

8,99% |

1,10 |

8,68% |

E |

15,0% |

10,57% |

1,30 |

10,25% |

F |

10,0% |

12,15% |

1,50 |

11,83% |

Portfolio |

100,0% |

8,31% |

1,01 |

8,00% |

| Market |

100,0% |

8,204% |

1,00 |

7,887% |

(c) ECOFINE.COM, Bernard Jaquier, Professor Emeritus & Dr Honoris Causa, Lausanne, Switzerland, 2025

|

|

|